You can sign up to our LinkedIn newsletter here.

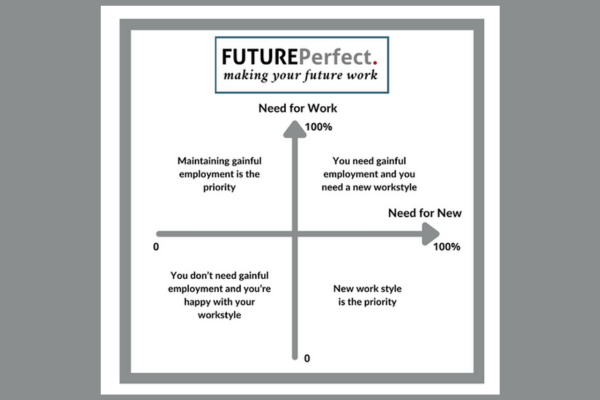

When I am working with you to help you think about your future, there are two crucial dimensions that I encourage you to examine. One is ‘need to work’ and the other is ‘need for new’. Let’s start with the ‘need to work’ dimension.

Need to Work

When explore your need to work, there are often three things that are involved.

One is your psychological and emotional need to be engaged in something rewarding, enjoyable and sustainable where you can feel you are making some kind of contribution. You want to continue to feel alive and for you work is a crucial part of that. It is one of the things that brings personal meaning and value to your life.

The second thing around this need to work is a growing recognition that your hopes for a fully funded retirement, at some magical age, are looking increasingly unrealistic. Why would that happen? Well, there are several things that can really undermine your retirement pot. If you have frequently moved between jobs so your pensions become very fragmented. You haven’t got access to a final salary scheme or or you haven’t consolidated them all into one pot. As you look at the bits and pieces you have picked up over the years, you realise that the total value of your projected pension at retirement will not be what you hoped it to be. What’s more, where if you did have defined benefits, those defined benefits related to a period when you were early in your career. Even though you may have been contributing consistently to your pension, it is not going to meet what you expect your needs to be. The annuity that you might be able to achieve on retirement will be lower than you hope for and what’s more, because you are now expecting to live 30 years beyond retirement and your annuity will be eaten away by inflation so that, in 30 years time it will look like a pittance!

Sadly, many you may have had a divorced at a point in your live when your earnings were at a peak, your pension pot is considerable and when you have made a significant contribution to paying off your first mortgage. At a stroke, all your assets are halved. In addition, you are faced with funding your children when they are living in another household. Suddenly your future financial outcome is looking very different. Perhaps, like many people, after the pain of their divorce, you have subsequently remarried. Perhaps you have new children. Like many people that I talk to in their fifties, you have children who haven’t yet reached their teens. If your youngest child is eight or nine and you are 55, then once they have come through university and need a deposit for a first house and the cost of an expensive wedding, it is 15 years later and your financial commitments have extended into your mid-seventies.

The children from your previous marriage, who might be five, ten years ahead, are coming into the most expensive time in their lives when you will have to contributed to university fees (and you may still contribute to school fees). The excess income you have got available to invest in your retirement has been substantially reduced. You may have thought that your early sixties would mean an end to your financial obligations to your children, your mortgage is paid off and you can maximise your contributions to your retirement. Instead, you are going to have substantial outgoings into your late sixties, early seventies, an unpaid mortgage and limited ability to save.

Or perhaps your one of those people whose career has had to restart. You have invested two years and tens of thousands of pounds in an MBA, or perhaps have returned from being overseas and its taken twelve to eighteen months to re-establish yourself in the UK. Savings have evaporated and the ambition of early retirement with a good income has disappeared over the horizon.

I am reminded of a guy that I met who was 63. He had been a very successful salesman building up international businesses. He moved with his family to France and invested in a French property. His marriage broke down and he hadn’t been able to get his next job. When we first spoke, he was living hand to mouth, responsible for two teenage children in rented accommodation, with no assets at all and very little prospect of work. His need to work was compelling and he knew that he would have to support his children for at least another ten years.

Need for New

I am reminded of someone I was talking to only the other week; he had been very successful as a CTO working for some highly, recognisable brands in financial services. He was delivering successful projects, was highly valued and very well paid. But he was bored! He did not want to go and build another product. He did not want to go and work in another big programme. He did not want to just design yet another technical architecture. He had recognised through his nearly 30 years of experience that I.T. is a fashion industry. The fashions had just come round again and again. It was the same problems and challenges, just presented in a different way.

He was bored! He desperately wanted something new. He was not going to be fulfilled by continuing to plough on as a CTO in large financial institutions. He cannot, at his age, give up his income so he needs to work. He has commitments to school fees, a mortgage and a family lifestyle that matters. He doesn’t feel he has the luxury of travelling around the world for two years or indulging in an 18 month programme of personal development and spiritual renewal. How can he look at some of his transferable skills, examine the different things he has learned and open up a new avenue where he can do something significantly new?

Well, for this particular person, he realised that he has got a broad understanding of the operations of a scale-up business, so can a position himself as a CEO of a technology business? Maybe there will be something else, maybe he will decide that he can move sideways role within financial services or technology.

What is it for you?

I remember a finance director that I talked to spent who 30 years with a very good career as a finance director. It was coming to an end and he wanted something new. What he realised was that, for him, the new was where he became a part-time finance director working for a range of smaller businesses. Now he is leading his own business serving CEOs of SMEs rather than being a divisional FD in a large Fortune 500 business.

So, what is the need for new for you?

We have a tool that you can run through and test this out for yourself at https://quiz.futureperfect.company/.

Look at that report it may well be very interesting what it makes you think about.

Charles McLachlan is the founder of FuturePerfect and on a mission to transform the future of work and business. The Portfolio Executive programme is a new initiative to help executives build a sustainable and impactful second-half-career. Creating an alternative future takes imagination, design, organisation and many other thinking skills. Charles is happy to lend them to you.